Welcome to Master the Meta, the #1 newsletter analysing the business strategy of the gaming industry.

Hi everyone,

On August 24th 2020, Unity filed its S-1, a ~300 page document jam-packed with information that not only explains what the business does, but also details how it scaled and what it wants to accomplish in the future. Plus, against the backdrop of Epic’s woes against Apple, the timing of this filing is nothing short of impeccable.

After seeing Unity’s brand and hype around the business grow in recent years, it’s definitely exciting to see rumors of Unity’s 2020 IPO finally come true. And since it is the first pure-play game engine company in history to go public, we had to take a deeper look — not only to understand the business engine behind the game engine, but also to analyse whether Unity is well positioned to realise its future plans. Let’s dig in!

Unity’s Core Business Offering

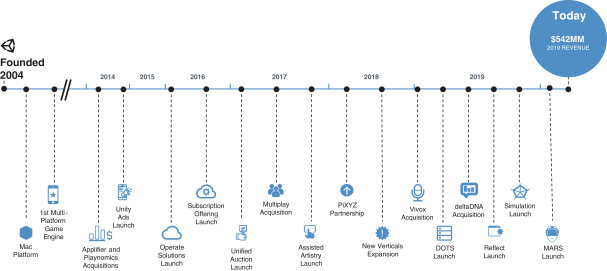

Unity was founded in 2004 with its game engine offering. And like many modern day game engines, Unity’s engine brought together a suite of tools — such as rendering, lighting, physics, sound, artificial intelligence, animation and user interface — under one hood. Underlying these tools was a core vision of wanting to make game development faster and easier. Unity has pursued this vision over the last 16 years, which now results in a variety of products that can be broadly bifurcated into “Create” and “Operate” solutions. Straight from the S-1:

“Our Create Solutions allow creators to develop interactive, real-time 2D and 3D games and applications. We generate Create Solutions revenue principally through the sale of subscriptions to our products and related support services. Additionally, we offer professional services to our larger enterprise customers to assist them in creating content and applications, largely based on fixed-fee contracts.”

“Our Operate Solutions consist of a portfolio of products and services that offer customers the ability to grow and engage their user bases, as well as to run and monetize their content, with the goal of optimizing end-user acquisition and operational costs while increasing the lifetime value of their end-users. Nearly all of our Operate Solutions can be used whether or not the content is built using our Create Solutions. Fees from our Operate Solutions are typically billed monthly.”

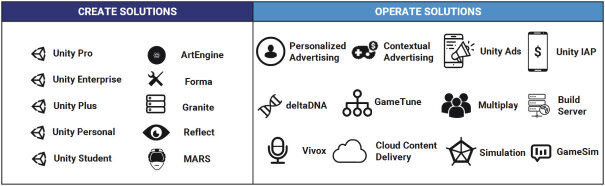

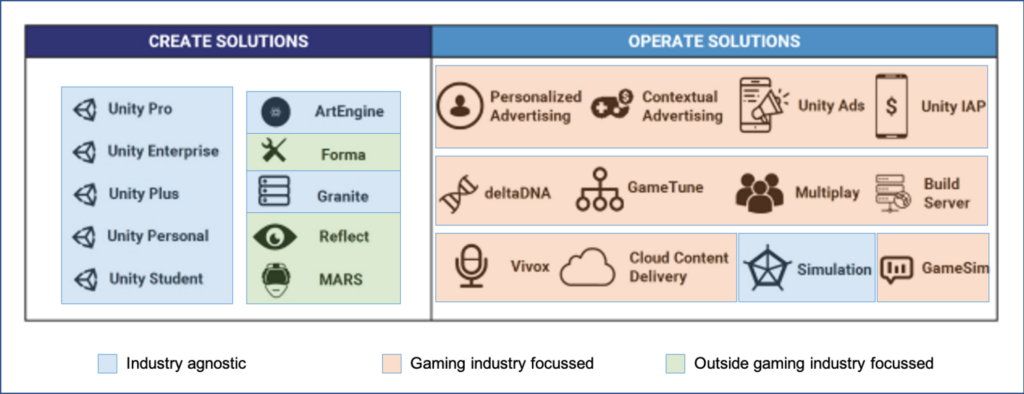

As seen above, Unity’s core business offering spans across 22 different products that run primarily through a couple distinct business models: subscriptions and revenue-share. Not only does this product portfolio cater to different customer needs, but they’re also marketed to 4 specific industry sets: Gaming; Architecture, Engineering and Construction (AEC); Automotive, Transportation and Manufacturing (ATM); Film, Animation and Cinematics (FAC). Three interesting observations emerge on a deeper look at the full suite.

1. Unity is gaming-first: The product portfolio is heavily focused on the gaming industry. On a pure product count basis, 50% are gaming focused, 35% are industry agnostic, and 15% are focused on non-gaming things. Also, if you look at the Operate Solutions (which is growing in importance), it’s clear that gaming is extremely front and center.

2. Growth through vertical integration: It’s interesting to study how this gaming-focused product portfolio came to be. Looking at Unity’s key milestone timeline, two points emerge. First, Unity did not create this product portfolio through purely in-house development, but it also accelerated portfolio expansion through tuck-in acquisitions.

Center to Unity’s strategy of growing through in-house development and acquisitions is vertical integration. Not only does the current product portfolio cover almost every part of the games-as-a-service (GaaS) value chain, but also it’s a great way to cross-sell and boost margins by retaining customers within the Unity ecosystem. Everything a games studio needs to Create and Operate a game for years is all under one hood.

3. Reaching the next frontier through in-house development: Despite being gaming-first, the gaming industry’s value chain is also not limitless, which is why Unity is now working harder to target new industries. This where the final piece of Unity’s offering —the non-gaming focused products (Forma, Reflect and MARS) — comes in. While we aren’t absolutely sure when Forma was launched, both Reflect (an architecture tool) and MARS (an AR/VR workflow tool) were launched within the last 12 months. Unity also recently acquired Finger Food, a Vancouver-based AR/VR company that provides tailored solutions to companies like Lowe’s, Enbridge, and Softbank Robotics that help solve complex business problems using advanced technologies like artificial intelligence, augmented/virtual reality, and robotics. Needless to say, all of this just shows how Unity is on a mission to expand its Create offerings outside of just gaming. The big question is whether Unity’s land-and-expand model works as successfully in non-gaming industries. Can Unity build a non-gaming focused set of Operate solutions that provide the same kind of revenue upside potential that the current set of gaming focused Operate solutions do?

Overall, Unity’s product portfolio growth strategy has been very measured over the past 16 years. The company constantly works to cover additional aspects of the gaming industry’s value chain, and Unity’s next focus is expanding outside of games. The next question obviously is whether this growth strategy can translate into solid business results.

Unity’s Business Metric Performance

Although some metrics are more impressive than others, Unity does show solid business performance. In order to understand where the company stands today, the risks it faces, and what the most lucrative opportunities for it will be in the future, there are three groups of metrics that are worth evaluating: customers, operations, and financials. Let’s tackle them one by one.

Customers

Unity’s boasts a 50% game engine market share with 1.5M monthly active creators as of June 30 2020, which is no small feat. That market share success is quite praiseworthy! Also, 93 of the biggest 100 game studios are Unity customers. And looking at the graph below, there is no doubt that Unity has done a wonderful job expanding the revenues generated from every consecutive annual customer cohort. Further, Unity has also managed to achieve a very impressive and healthy global revenue footprint - US (28%), EMEA (34%) and APAC (22%).

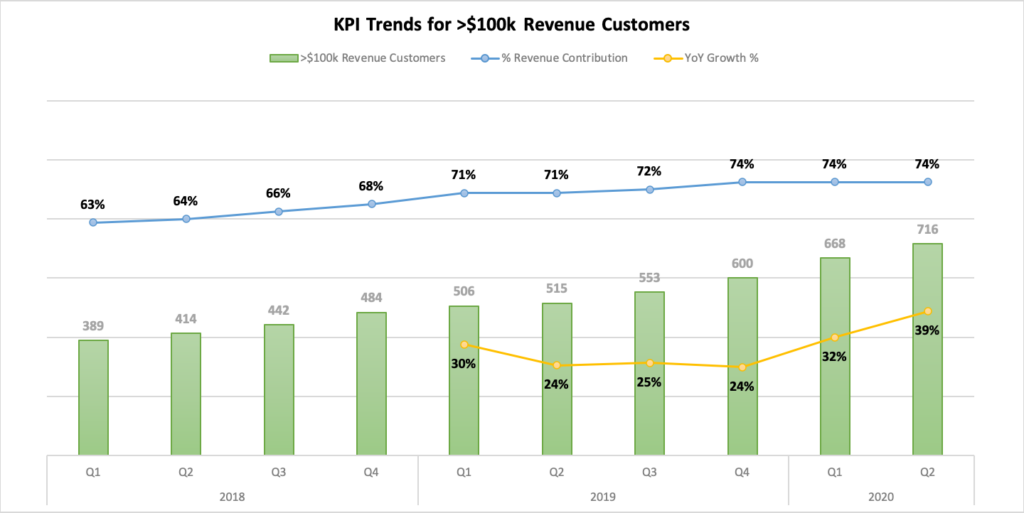

There is one customer segment that is particularly important to study: customers who provide over $100k in revenue each year. These “>$100k revenue customers” showcase the strength of Unity’s value proposition and ability to upsell across the product portfolio.

As of June 30 2020, Unity reported 92% of their 716 >$100k revenue customers were in the gaming industry. And as can be seen in the graph below, this customer segment generated well over half of Unity’s revenues since the start of 2018 and consistently contributes over 70% of quarterly revenues since the start of 2019. Of course, none of this is surprising given Unity’s gaming-first focus to grow the business.

Further, the YoY growth rate of “>$100k revenue customers” continues to be in the healthy double digits. The sudden acceleration in 2020 (so far) is likely COVID-driven and will return to more normal levels (perhaps mid-20% growth) once the COVID effect starts to wane across the globe. The impact of COVID can also be seen in the % revenue contribution of this customer segment over the last 3 quarters. This stagnation (at 74%) is likely due to an acceleration of revenue from customers that contribute less than $100k in 12 month trailing revenue. In other words, the rising tide of COVID raised all ships.

As seen in the chart below, Unity has done a great job growing its revenue per customer (among the >$100k revenue customers) to $191k, which is a close to +50% increase over the last 2.5 years. With over 90% of these customers belonging to the gaming industry, this big increase in revenue per customer since the start of 2018 is a testament to Unity’s vertical integration product strategy and ability to upsell various Operate solutions. Additionally, these high value customers have a 99% retention rate, which speaks volumes to the stickiness of Unity’s ecosystem.

Having said that, the growth in revenue per customer has significantly decelerated recently. This may be impacted by the growing number of new >$100k revenue customers (who bring the average down), but it does point to Unity’s challenge of finding new ways to upsell and cross-sell existing customers. Unity obviously wants to acquire more high value customers, but since the company already holds high market share in gaming and game engine switching costs are high for developers, acquiring new customers through stealing market share will prove difficult.

Of course, one key metric for Unity (and software companies in general) is the Dollar-based Net Expansion Rate. Essentially, when this number is greater than 100%, it means that existing customers from a year ago spent more money recently (on average) than they did previously. Similarly, when this number drops below 100%, it means churn and downgrades had a larger financial impact than cross-selling and upselling across existing customers did. For Unity, this metric is stellar — right in line with many of the better performing SaaS companies on the market.

Overall, it’s clear that the >$100k revenue customer segment is the bread and butter of Unity’s business. Moving as many customers as possible into this segment, retaining the existing ones, and finding new ways to upsell/cross-sell these top customers will drive the company’s long-term revenue trajectory. So far so good.

Operations & Financials

It’s great to see Unity’s consistently strong revenue growth! Additionally, gross margins for this business are quite impressive, both in terms of consistency and averaged absolutes of ~80%. But there are two points to note here.

First, despite incredible ~50% market share, it strikes us as odd that Unity only grossed ~$542M during 2019, which definitely feels like a drop in the TAM ocean. Unity’s ultimate “take rate” is quite low in terms of the total value created using its tools.

Second, Unity has experienced consistent losses over its history. That’s not abnormal compared to other software companies in similar stages — reinvesting for growth at a loss is fine if the unit economics are solid and the TAM is huge — but, again, given the company’s dominant market share we’d be more impressed if they had translated that dominance into profits more easily. That said, a deeper look is required before raising any alarm bells.

Yes, Unity has experienced regular losses and negative free cash flow to the tune of -$120M and -$95M during 2018 and 2019, respectively. But the more important point is that the losses are shrinking as a percentage of revenue, a sign of management’s ability to manage costs. Further, Unity possesses a net-cash balance of $329M, which will only strengthen as the company raises capital during its IPO. In other words, the losses are both intentional and manageable, and as the company further scales revenue over its operating costs (primarily R&D + sales), we believe that a path to profitability easily exists. Unity is smart to heavily reinvest into the business and play the long game, which will ultimately make its profits down the road much larger.

Currently, Unity’s revenue is almost entirely getting eaten up by various operating expenses. It is good to see S&M costs on a general downtrend, which does speak to Unity’s cost controls and continued growth of brand value in the market. G&A costs also seem to be in a reasonable range, given Unity’s massive 3.3k+ global headcount. Additionally, a huge percentage (~50%) of revenue is being reinvested back into R&D efforts with 56% of the workforce being dedicated to it, which is intriguing and hopefully encouraging.

Investing heavily into R&D is how Unity hopes to maintain its dominant market share. But here are a couple observations. First, if Unity is serious about growing non-gaming industries as a % of revenue, heavy spending on R&D is definitely required to make that a reality. Different industries necessitate different tools; a one-size-fits-all tech stack is tough to make work. Second, high R&D spending despite high market share is a sign that the game engine market remains highly competitive.

It’s also critical to note that Unity’s Operate Solutions generate the lion’s share of the company’s total revenues — now up to ~60% in Q2 2020. And remember, 92% of its 716 >$100k revenue customers are in the gaming industry. In other words, the Operate product suite is primarily gaming focused and its growing revenue contribution is driven by a usage-based/revenue-sharing model that, unlike the flat-fee Create Solutions, allows for much more scalable revenue potential. It’s slightly disappointing to see the Operate solutions revenue not be broken out by product category, but we expect that a good chunk of it is driven by Unity’s various ad offerings. Advertising is definitely a fragmented market but still relatively dominated by Facebook and Google, which is yet another element of competition. Furthermore, Apple’s IDFA deprecation plans pose a real business risk, as it remains to be seen how much the rollout of iOS14 will negatively affect the mobile ad tech value chain.

Finally, we were surprised to see that Unity’s Create Solutions only generate ~30% of the company’s overall revenues, totaling a relatively tiny ~$170M in 2019. There are likely two drivers for this small revenue volume. First, every time Unity mentioned a ~50% market share in its S-1, it also made sure to mention this number next to the number of games “created” with Unity, not “operated.” Also, Unity’s engine has a free tier, which likely makes up a majority of this high market share. Second, the fixed-price subscription model for Create Solutions means there’s limited scalability in that side of the business model. In other words, Unity’s business model with Create Solutions equates to having an extremely low “take rate.” While there’s certainly growth opportunities here, converting free plan customers to paid ones and changing subscription pricing schemes are inherently not easy tasks. More on this later.

Overall, even though Unity has consistently experienced R&D-driven operating losses, its shrinking cash burn, strengthening balance sheet, and plans to grow revenues from non-gaming customers helps justify its significant R&D investments. Although it will be interesting to see whether Unity uses the same strategy to grow revenues from non-gaming industries, onlookers should expect Unity to continue generating operating losses for a while longer. Of course, it will be worth the wait if it leads to greater non-gaming success and long-term path to higher profitability.

Unity’s Future

In a nutshell, Unity’s path to scalable profitability — and becoming a killer company in general — relies squarely on 1) growing its customer count, 2) maintaining high customer retention, and 3) successfully cross-selling / upselling existing customers — within the gaming industry and beyond.

Within the Gaming Industry

Despite high existing market share and rising gaming-related Operate Solutions revenue, Unity continues to double down on a gaming-centric land-and-expand strategy. This strategy (in combination with high gross margins) lays the foundation for a very compelling business… but not without some potential headwinds.

For one, although Unity’s high market share and brand presence ensures that many new creators will adopt its Create Solutions, this side of the business has limited upside (at least with the current pricing scheme). Its top line contribution is shrinking and it’s far less scalable than Operate Solutions. A majority of Unity’s “customers” will continue to use the free tier, and high R&D costs are required to maintain market share, especially with Unreal being the alternative. Even though capturing additional market share will be tough, growth will really come from converting more of its free tier customers to a paying tier and then up/cross-selling them into various Operate solutions (and then ideally to >$100k customers). On a positive note, Unity’s >$100k customers already boast a 99% retention rate, but only ~55% of those customers use both Create and Operate solutions. With such a high retention rate, there is definitely an opportunity to move that latter percentage much higher.

All this is easier said than done. Persuading big studios to opt for Unity over Unreal remains a challenge for many projects. Also, overcoming high game engine switching costs is extremely challenging, especially when big studios have worked with another engine for years. A common industry perception is “Unity for ease, Unreal for quality”, and Unity’s dominance in quality-varying mobile games versus Unreal’s foothold in high quality PC/Console titles backs that up. Interestingly, Riot recently announced that it’s using Unity for two upcoming projects; they made a very curious statement: “From the beginning, we wanted Legends of Runeterra to be available on both PC and mobile, so Unity was the obvious choice”. The easy counterpoint is Fortnite, which is built on Unreal and also cross-platform, but comments like this are positive signals that Unity may have an edge in certain projects that mandate cross-play. That’s good news since cross-play will inevitably expand in popularity.

Unity’s Operate solutions still hold upside, but the revenue mix — ads vs in-app purchase revenues, in particular — remains unclear. Given how solutions like deltaDNA (analytics) and Vivox (player-to-player communications) drove less than 10% of overall revenue, we known the majority of Operate Solutions revenue is driven by monetisation products, and we expect it is skewed toward ads. Of course, with Facebook and Google taking up a majority of the mobile advertising market, Unity has nothing more than a toehold here. And while Unity can definitely continue improving its ad monetisation offering with R&D, the breadth and depth of data, infrastructure, and solutions that Facebook and Google already have to serve the needs of gaming advertisers and publishers is really unparalleled, making them tough to compete against. Further, Apple’s plans to deprecate the IDFA is probably not going to make Unity’s efforts to grow revenue through its ad monetisation solutions any easier. Even Facebook publicly accepted a potentially huge hit to revenue and eventual deprecation of their most popular ad product FAN (Facebook Ad Network) with iOS14 rolling out. And finally, Unreal seems to be catching up with their own live services offering - though no mention of ad-based solutions as yet.

Beyond that, there are more Operate Solutions Unity could consider targeting: more live ops services, more user acquisition tools, etc. Also, Unity’s focus on being a market-leading provider for AR/VR experiences is definitely a great future-proofing strategy for customer growth, but mass adoption of AR/VR within the gaming industry is still in the far distance. It will likely take a while before any investments by Unity in this space start to pay off at scale. Also, like in mobile gaming, the real money in this strategy lies in the Operate segment, which is a big question mark. Can AR/VR games and experiences be monetized in a way that Unity can capture revenue-share upside (ads & IAP)? We’re not sure but note that Unity is working on solutions. For example, they are already investing in building out an advertising in AR/VR solution. Also, a very surface level analysis of this space does showcase some interesting (and positive) data trends around the future potential of AR ads, which, of course, entirely hinge on AR/VR adoption rates.

Outside the Gaming Industry

Unity estimates that its TAM outside the gaming industry is $17B today, versus gaming’s TAM of $16B by 2025. Plus, as we alluded to earlier, Unity also reported that only 8% of its 716 >$100k revenue customers are in non-gaming industries. In other words, Unity is a gaming-first company but views its opportunity outside gaming to be a much bigger one. The question is: can Unity’s current product suite work well in other industries? Let’s use the example of the Automotive industry first.

Given how Unity’s Operate Solutions is highly gaming focused, it’s safe to assume that the company’s Automotive customers primarily interface with the Create side of the business. And when it comes to Unity providing solutions that plug well into the automotive industry, opportunity lies in some key areas, such as Computer Aided Design (CAD). While one strategy could be to create standalone solutions that compete at various steps of the CAD value chain, additional value for the market could also be generated through partnerships with key CAD players like Autodesk. For example, while Autodesk’s product suite is well positioned to create high quality 3D models of cars, experiencing that car model in an interactive 3D environment to drive both product decisions and customer sales is where Unity’s Create offering comes in. It is through such partnerships outside the gaming industry that Unity could increase its revenue within the Create Solutions and Strategic Partnerships segments. But a few points need to be considered first.

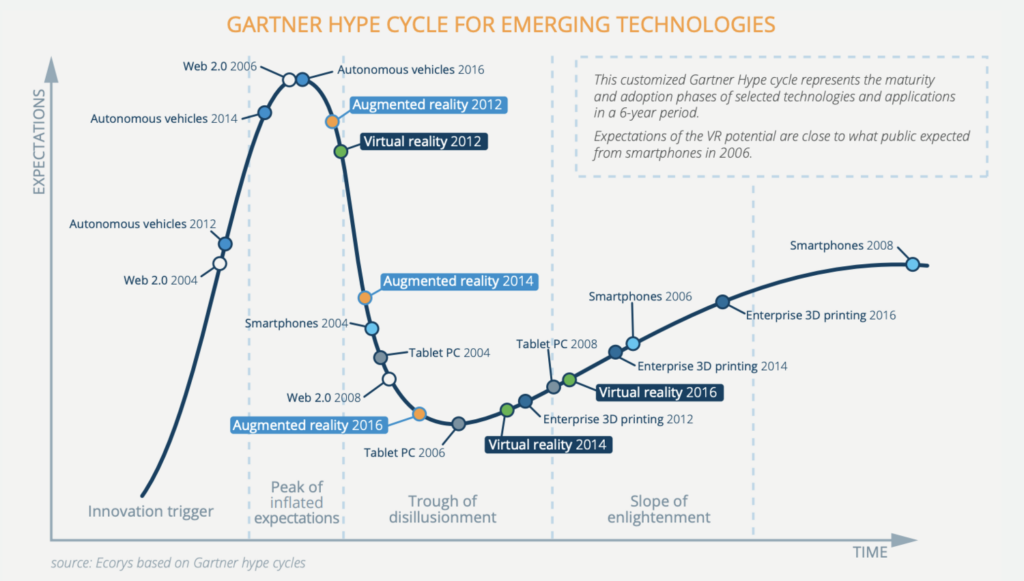

VR/AR adoption rates outside gaming: Based on the customised Gartner Hype Cycle below (created in a VR market research report for the EU), it is clear that VR/AR are slowly inching towards the Plateau of Productivity. From the report:

“This development has been observed for all technologies we are using today – be it tablets, video gaming, 3D printing or e-banking. The pattern coincides strongly with the product life cycle where new technologies are first applied by early adopters, which can be observed at present, eventually followed by a fast increase in demand and production.”

In other words — and based on the findings of this report — Unity seems to have picked the right time to invest in customer growth through these technologies. These emerging technologies have significant room to mature before demand spikes, but signs are increasingly positive.

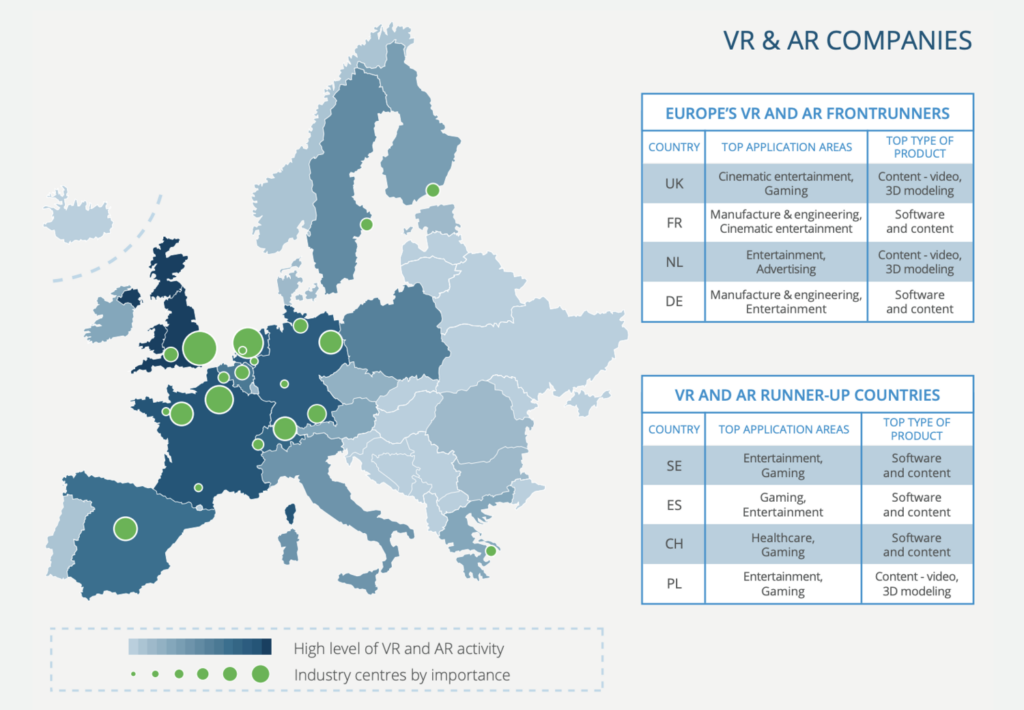

The same market research report also looks at the major applications of VR/AR across key EU countries. Apart from “Gaming”, “Cinematic Entertainment” and “Manufacturing & Engineering” also popped up as key application areas — two industries that Unity is hoping to expand into. Additionally, Unity is already collaborating with some of the top automotive companies globally, like Toyota, Tesla, Volkswagen, Daimler and Honda to integrate these technologies deeper into their operations. While we weren’t able to find a credible enough source for AR/VR adoption rates by industry vertical, the above data indicates that Unity’s focus on providing realtime, interactive 3D solutions outside gaming is a fair expansion strategy. But there might be one problem…

Operate solutions for Unity’s outside gaming customers: Unity’s long-term success partially hinges on the company’s ability to implement its land-and-expand strategy across industries. This means it is critically important that Unity uses its Create arm to capture market share in non-gaming industries and then cross-sell those customers into a strong suite of Operate solutions that increasingly serve new types of use cases. Adding new industry-specific Operate solutions is a huge and still largely untapped opportunity, and this is what will enable non-gaming revenue to dramatically scale. In the S-1, Unity mentioned that they hope execute on this, but it didn’t come across as a top priority.

Pricing models for non-gaming Create Solutions: The fixed-price nature of Create Solutions naturally limits revenue upside, so Unity has to find other ways to scale. At minimum, the company can try to sell more seats to existing companies and eventually raise the price of $200/month/seat for the enterprise-level solution. It also means, especially for games-focused businesses, cross-selling Operate Solutions, but that doesn’t apply to every business in every industry. One potential way to bypass this business model limitation is to prioritize Strategic Partnerships. For context, Strategic Partnerships contributed ~9% of total revenues over the past year and the work and terms are usually highly customized. Although it might be a way to find more revenue upside on a per-customer basis, constantly customizing partnerships usually isn’t an efficient way to scale. The way Unreal side-steps this issue is by operating on a purely royalty-based model, which means the company gets a cut of revenue upside across any industry (more details here). Perhaps Unity could do something similar. Either Unity could entirely pivot to a one-size-fits-all royalty-based model (unlikely) or it could introduce industry-specific pricing schemes that, combined with industry-tailored tech offerings, allow for more upside in more industries. In general, if Unity wants to create a better business model for non-gaming customers, the company has a couple options worth exploring.

Competition from Unreal: Unity is sometimes viewed as the Pepsi to Unreal’s Coke across industries. While both engines have strong customer acquisition funnels, Unreal is not only open-source (which accelerates R&D) but free to use until revenues hit $1M, after which a 5% royalty fee kicks in. Given how Unreal targets the same non-gaming industries as Unity and how Tim Sweeney views the business opportunity outside gaming similarly to Unity, it seems like many of these customers are using both engines either directly in their operations or through external partners. For example, Volvo partnered with Varjo to create a MR demo using Unity (and now Varjo is part of the Epic Grants program); BMW uses Unity and Unreal; and Skanska, one of the world’s largest construction companies, uses a mix of Unity and Unreal through its collaborating partners.

Beating out Unreal — or at least better competing — will come down to figuring out who’s underserved, designing tailored end-to-end solutions to satisfy those needs, converting large customers, and eventually turning them into >$100k customers. Unity is definitely on that path, but there’s a long road ahead.

Leadership team makeup: If Unity wants to better succeed in other industries, it probably needs expertise across domains. We can look at the current leadership team to get a general (yet imperfect) understanding of who has expertise where. At a high level view, Unity’s leadership definitely feels light on the non-gaming front. Is that a negative signal? Maybe. At minimum, Unity will need to hire more diverse domain experts in key roles, which seems doable, but it’s clear that leadership is still very much focused on gaming. That’s no surprise.

Our Verdict

Unity’s market share success should be praised, and even though we’re surprised the company isn’t bigger given its market share, the company’s fundamentals will clearly improve with scale. Over the last 16 years — and especially recently — Unity has shown mastery in executing a gaming-centric land-and-expand strategy. It has amassed a strong competitive position, a large high-value customer base, and a proven ability to upsell/cross-sell every year. Even though the company has experienced losses since inception, the losses are shrinking as a % of revenue, customer retention is excellent, and Unity is playing the long-game with its heavy R&D and sales investments. In other words, it’s laying the foundation to not only stay relevant but become an even bigger and more profitable company in the future.

There is still plenty of upside to capture both within the gaming industry and outside it. Within gaming, there’s plenty more room to cross-sell Unity’s existing customer base across existing and new Operate Solutions, which will create more >$100k revenue customers and increase the average revenue per customer. This is the primary means by which the company will scale and improve its operating margins in the near future. There are definitely uncertainties — how many more big gaming companies can Unity capture? what does the IDFA apocalypse mean? how fast will Unreal catchup on live services offerings? etc. — but the general trajectory is undeniably positive.

Also, although Unity is still very early in implementing its land-and-expand strategy outside of gaming, it’s smart (not to mention expected by investors) to be tackling new industries. The AR/VR, automotive, film, and manufacturing industries, in particular, hold significant upside if Unity succeeds in solving underserved needs. There is definitely heightened business model risk here — how can new Operate solutions or new pricing models bring revenue upside to other industries? what can Unity do that Unreal doesn’t?— but it’s not an unsolvable task. It will just take meaningful reinvestment over many years and a willingness to evolve to make work. Despite the huge opportunity, there’s still a lot to prove.

It was a pleasure to read Unity’s S-1 and share our takeaways with all of you! This is the first game engine pure play to go public so we wouldn’t dare miss the opportunity. In summary, Unity is an exciting business with plenty of room to grow, and although we still have lingering questions about the company’s ability to become a multi-industry titan, we’re definitely rooting for the team’s success! It’ll be fun to follow and write more about over the years ahead.